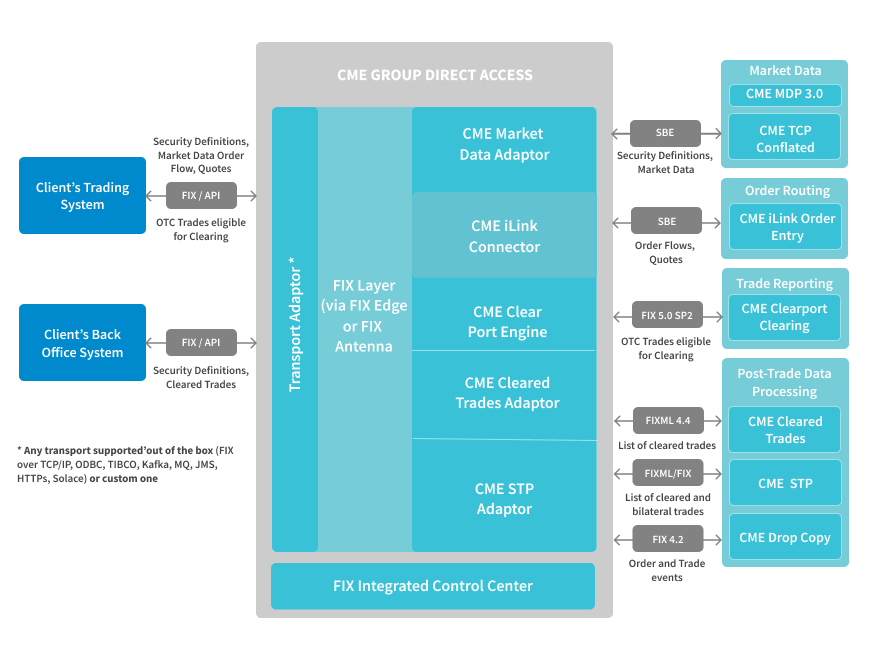

EPAM provides pre-certified solutions for direct access to CME Group Inc.:

All solutions described above are equipped with rich UI simplifying configuration and maintenance, as well as allowing the monitoring of session statuses and parameters in real time on desktop app or web browser.

Market Data

EPAM B2BITS Market Data Adaptor provides support for the CME Market Data Platform - CME MDP 3.0, EBS, BrokerTec, Globex.

The CME MDP 3.0 Market Data Adaptor allows maintaining a subscription to one or multiple instruments and supports all features of CME market data channels (including recovery) with latency of under 2 microseconds.

- Maintains connections to the CME Market Data feeds via UDP (Snapshots feed, Security Definitions feed, Incremental Updates feed) and to CME TCP replay channels

- TCP Conflated Handler ensures low-latency delivery of market updates, significantly reduces bandwidth consumption and processing overhead, allowing for faster and more efficient data handling

- Hides FIX/SBE details from user, automatically applies FIX/SBE decoding

- Provides the ability to load a CME configuration file to use connection parameters and a FIX/SBE template file to adjust FIX/SBE decoder accordingly

- Automatically builds and updates order books from market data snapshots and incremental messages

- Support protocol v13

- Provides a C++/ .NET/ Java API to subscribe/unsubscribe by symbol, to receive security definitions, snapshots, increments, news, and security statuses via call-backs

- Provides the ability to customize logic on a low level to define custom recovery strategy

Order Entry

iLink Binary Order Entry

CME iLink handler (available in C++(HFT) and Java) is preconfigured to fully support iLink Binary Order Entry for submitting orders and receiving order entry responses, and has the following features:

Supports all requirements of the CME iLink Order Entry interface including the following ones:

- Low-latency Simple Binary Encoding (SBE)

- FIX Performance (FIXP) protocol for session management

- Week long session support and audit, and mid-week initialization

- Supports CGW and MSGW architectures

- Access to all market segments on the CME Globex platform

- Ability to send/receive raw SBE (binary) data

- Supplied as a library (.dll/.so) with a user-friendly, intuitive API

- Support CME BrokerTec Order Entry

- Support EBS (compatible with EBS FX Spot+)

- Support protocol v8

- iLink binary logs to FIX/ HumanReadable converter is included in the package

- CME Audit Trail report generation tool is included in the package

- High performance/Low latency: in C++ implementation deliveries over 60,000 messages per second on a single CPU, and adds up to 16 microseconds' latency on 100 Mbps network with persistence and 6microseconds' latency on 100 Mbps network without persistence.

Post-Trade Data Processing

Addressing an industry need for automated solutions in post-trade data processing, B2BITS provides the FIX Trade Capture solution (FIXTCap) for direct access to the following CME interfaces:

- CME STP

- CME STP FIX

- CME ClearPort (trade retrieval for Brokers)

The solution is designed to support all specifics of CME interfaces, delivering post-trade data and simplifying the process of capturing trades.

Key Features:

- Support for CME cleared and bilateral trades across all asset classes traded at the following CME divisions:

- CME, NYMEX, COMEX and CBOT Trading Floors

- CME Globex (CME, CBOT, NYMEX, COMEX, DME)

- CME ClearPort (CPC)

- CDS via CMD (CMD)

- Support for the following user roles:

- Trading Firms / Asset Managers / Brokerage Firms

- Support EBS

- Completely encapsulated and hidden from the client connectivity specifics

- Pre-configured Trade Capture report subscriptions for automated Trade Capture background service

- Flexible user-controlled Trade Capture report subscriptions via FIX protocol API

- On-the-fly CME FIXML / XML ↔ FIX 4.4 conversion via flexible, easy to configure and maintain xsl-based data mapping

- Multiple ways for integration with End-user, back-office, or 3rd party ETRM system via:

- FIX 4.4 Interface

- various middleware: database, TIBCO, MQ, JMS and others supported by FIXEdge

- On-demand recovery tool to prevent trade loss in case of failure

- FIXEdge features inheritance, allowing seamless integration with internal the Client's systems via ODBC, TIBCO, MQ, JMS and other middleware.

For Users searching for small lightweight solutions, Database loaders for CME Post-trading data are available. These tools are pre-built for MS SQL/Oracle databases, automated, and standalone applications, consuming trades from CME ClearedTrades, ClearPort (brokers-specific) or STP APIs.

Trade Reporting

CME ClearPort Engine is a FIX Antenna®-based solution, allowing its users not only to report trades for CME, CBOT, NYMEX, COMEX and DME products to CME ClearPort via FIXML 5.0 SP2, but also allows requesting a list and details of tradable securities, as well as entity reference data.

- HTTPS support, encapsulation and masking of the connectivity specifics.

- Fully supports workflow defined by CME ClearPort

- High Performance/Low latency support (inherited from FIX Antenna)

- User-friendly, intuitive public .NET interface

The deployment of this solution will provide the following benefits:

- Pre-certified with CME Group Inc.

- Quick start and benchmark samples assuring prompt familiarizing with the software

- Re-use of a proven and certified technology with direct market access

- Reduced time to market and cost of implementation & operation

- Lower technical risk for support and maintenance

- FIX Engines and FIXEdge provide access or modify any business level tag in the message and allow creating flexible business rules

- Easy to configure the business rules without programming skills

- 24x7 support provided worldwide

- Provides consulting and customization services for end-user specifics and requirements

- Availability of "on-demand" software escrow