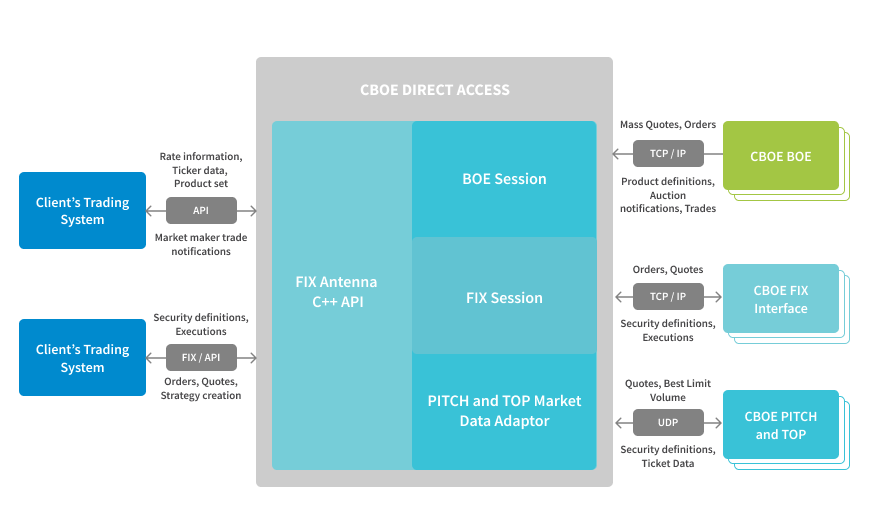

EPAM provides pre-certified connectivity solutions for direct access to the following feeds and interfaces of Chicago Board Options Exchange:

BOE Order Routing engine

B2BITS BOE Order Routing engine is a low latency solution specifically designed and preconfigured to fully support the BOE Order Routing interface of the CBOE Command trading system and have the following features:

- Connects and maintains connection to the BOE Order Routing interface of CBOE Command via TCP/IP

- Supports all the features of the CBOE Command trading system for order routing and market making, including mass quoting, product information retrieval, and status updates

- Provides the ability to define and trade multiple leg instruments, such as options strategies and futures calendar spreads

- Supports GMD Acknowledgement of reports for an order or quote after a trade

- Provides the ability to enable a Quote Risk Monitoring (QRM) functionality and set quote risk controls.

- Allows subscription to Auction notifications

- Allows product downloading for trading session or for class (options, futures, strategy, equity) traded at CBOE

- The latency is under a microsecond between creating an order and sending it to the socket, and from the socket to call-back while getting a message

- Provides a flexible C++ API to receive rate information, market maker trade notifications and all strategy related messages

PITCH and TOP Market Data

B2BITS PITCH and TOP Market Data Adaptor is a connectivity solution for receiving market quotes, orders and trades data from CBOE Markets data feeds, with the following features:.

- Connects and maintains connection to the PITCH and TOP feeds via UDP

- Provides the user with current market and ticker data available at PITCH and TOP (quotes, best limit volume, ticker data, security definitions)

- Automatically arbitrates between primary A and secondary B data feeds

- Supports a CBOE data recovery mechanism

- Cboe US Options Exchanges (BZX Options Exchange "BZX", Cboe Options Exchange "C1", C2 Options Exchange "C2", and EDGX Options Exchange "EDGX")

FIX Order Entry

FIX Order Entry engine based on the FIX Antenna® library or FIXEdge® application server provides access to CBOE direct to enable trading in all major asset classes - options, futures, options of futures and equities on a single platform and has the following features:

- Connects and maintains connection to the CBOE FIX Interface via TCP/IP

- Fully supports CBOE FIX Order Entry Interface workflow

- Supports CBOE FIX 4.2. and 4.4. dictionaries

- Supplied as a library (.dll/.so) with a user-friendly, intuitive ANSI C++ / .NET / Java public interface or as a standalone application

- High performance/Low latency: in C++ implementation deliveries over 60,000 messages per second on a single CPU and adds up to 16 microseconds' latency on 100 Mbps network with persistence and 6microseconds' latency on 100 Mbps network without persistence.

- Equipped with rich UI simplifying configuration and maintenance as well as allowing monitoring session statuses and parameters in real-time on desktop app or web browser.

The deployment of this solution will provide the following benefits:

- Pre-certified with CBOE

- Quick start and benchmark samples assuring prompt familiarizing with the software

- Re-use of a proven and certified technology with direct market access

- Reduced time to market and cost of implementation & operation

- Lower technical risk for support and maintenance

- 24x7 support provided worldwide

- Option to have solution customized to end-user specifics and requirements

- Availability of "on-demand" software escrow