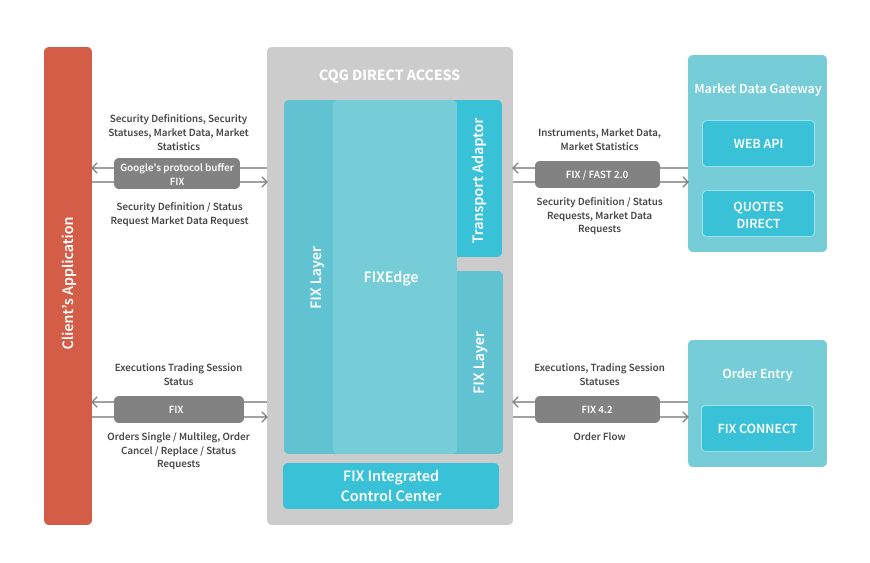

EPAM provides pre-certified connectivity solutions for direct access to CQG Market Data and Order entry interfaces.

The CQG Direct Access solution works out of the box as a background service and does not require additional coding, except for business logic and / or integration with client middleware. This solution is created on the basis of FIXEdge, and therefore inherits all its features: /trading_solutions/fixedge .

CQG Web API Market Data

The FIXEdge CQG solution provides an application with access to the following information:

- Streaming Level 1 and Level 2 data

- Historical tick, intraday bar, and daily bar data

- Order execution, account summary, order history, and post-trade analysis

FIXEdge connects to the CQG Web API Market Data interface, and it uses customized Google's protocol buffers (GPB) and secure WebSockets technology for data delivery. The CQG Transport adapter converts the GPB protocol to FIX.

The solution has the following features:

- Supports Market Data messages like MD Request, MD Request Reject, MD Snapshot

- Provides a FIX API for subscription to market data (i.e. a bid, an offer, a trade associated with a security, the opening, closing, or settlement price of a security)

- Order book management by Price and by Order, controlled by subscription request

- Primary and backup connections

- Authentication

CQG Quotes Direct Market Data

CQG Quotes Direct allows clients' applications to subscribe to one or more instruments available at CQG Quotes Direct Data Sources and has the following features:

- Maintains connections to CQG Snapshot UDP multicast group feed channels

- Supports instrument recovery by connection to the Replay Server via TCP

- Connects to the Security Definition Server and receives Security Definition

- Supports client's authorization

- Provides a FIX API for subscription to quote market data

CQG FIX Connect (Order Entry)

CQG Order Entry Engine allows sending orders to the CQG gateway and receiving trades and orders statuses via FIX protocol. It is a FIX Antenna™-based, low latency solution. The solution is supplied as a library or a server application and has the following features:

- Connects and maintains connection to the CQG trading API via TCP/IP

- 100% FIX 4.2 standard compliance

- Supports message validation and FIX Protocol customization as per CQG conformance requirements

- Supports user-defined tags

- User has full access to all FIX message fields.

- Fully supports all administrative and application messages according to CQG FIX specification

- Flexible configuration of trading hours and sequence reset control via cron-like expression

- Automatic recovery of missing messages according to FIX standards using a resend request

- Supports drop copy functionality

- High performance/Low latency in C++ implementation:

-

- FIX Engine is able to handle more than 500 sessions

- FIX Antenna C++ adds about 18 microseconds latency (with 99 percentile) and the maximal total steady throughput is about 500000 msg/sec

- Message persistence and FIX version conversion. About 1000 msg/s incoming throughput and 100 000 msg/s outgoing throughput

- No message persistence and FIX version conversion. About 2000 msg/s incoming throughput and 200 000 msg/s outgoing throughput

- Provides administration utility, allowing monitoring session statuses and maintaining configurations in real time

The deployment of this solution will provide the following benefits:

- Pre-certified with CQG

- Quick start and benchmark samples assuring prompt familiarizing with the software

- Re-use of a proven and certified technology with direct market access

- Reduced time to market and cost of implementation & operation

- Lower technical risk for support and maintenance

- 24x7 support provided worldwide

- Provides consulting and customization services to end-user specifics and requirements

- Availability of "on-demand" software escrow

For more information about CQG Direct Access please contact us at sales@b2bits.com