One of the largest brokers operating in the energy and commodities markets. It offers also brokering services in fixed income securities, interest rate derivatives, treasury products, equities.

Customer

Challenge

The Customer choose EPAM Systems to develop a market data publishing system to meet the regulations of MiFIDII.

Solution

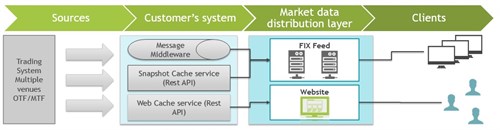

EPAM built a MIFIDII compliant market data distribution layer, which is publishing the data adhere to the regulatory requirements and the data follows the "Liquidity Thresholds" set by ESMA. This market data distribution layer provides access to multiple MiFID trading venues from different pools of liquidity.such as CLOB, RFQ, and auction trading systems.

Data is published in machine readable (FIX feed, used by organizations/entities) and human readable (Web, used by individuals) formats.

FIX Feed

- Provides a FIX interface for sending pre and post trade transparency data

- Supports the latest changes of FIX protocol (extension packs for MIFIDII)

- Performs message conversion from Protobuf and JSON format to FIX

- Undertakes basic validation on incoming messages (fields missing, field formats)

Website

- Provides a Web UI interface for sending pre and post trade transparency data

- Publishes real-time and 15 minute delayed datasets

- Supports disaggregation by instrument type, ccy and/or country required by RTS 14

- Enables integration of third party components: SSO providerand Captcha service

Key highlights of the solution:

- Robust/fault tolerant architecture

- Scalable, multiple instance design

- Generic covering multiple exchanges

- Subscription business rules flexibility

- Variety of asset classes: FX including forwards, Equity Derivatives, Commodity Derivatives, Credit Derivatives, Securities, Interest Rates Derivatives.

Technologies and Tools

Results

The project was successfully implemented and has been working in production since January 2018. The publishing system is MiFIDII compliant. EPAM Systems continues cooperation with the Customer and provides post implementation support.