High-performance Solution Stack Overview

A consortium of leading IT vendors was formed to create demonstrable high performance solution stacks to address common business requirements in financial trading. A series of tests were undertaken at the Intel fasterLab facility in the UK that demonstrate the value of commercial software (versus open source) and the use of specialist technologies in low latency infrastructure.

"OnX Enterprise Solutions Ltd is leading a consortium whose charter members include Intel, Dell, Arista Networks and Solarflare Communications, with additional services provided by Edge Technology Group, GreySpark Partners and Equinix. The foundation objective is to create transparent comparative performance statistics for key functions along the trading life cycles using business workloads - FIX being used on a number of legs of the typical trade life cycle."*

The following platform was used in these tests: Intel® Xeon® processor X5698 (dual-core), clocked at 4.4 GHz with Solarflare SFN5122-F 10G NIC OpenOnload kernel bypass, Red Hat Enterprise Linux (RHEL 6.0).

Test Harness Overview

"The diagram below illustrates the test harness with its simulated market data and execution venue.

- The benchmark process was repeated as part of 3 different test cycles covering short to extended duration periods. Each set of benchmark cycles was repeated 3 times, in order to establish mean latency figures of the FIX engines. The 3 intended test cycles were:

- Burst test - where 50,000 market data messages per second were generated by the market data simulator for a period of 5 minutes.

- Sustained test - where market data message rates were increased from 10,000 to 100,000 per second, by 10,000 every 4 minutes, for a total of 40 minutes.

- Extended sustained test - where market data rates were increased from 10,000 to 50,000 per second, by 10,000 every 10 minutes, and then held at 50,000 for a total time of 4 hours."*

The latency was measured as the time span between two correlated events on the wire: an inbound FIX market data message packet and the resulting outbound FIX order message packet.

The accurate time measurement was supported by the Endace™ network monitor card.

B2BITS FIX Antenna® C++ v2.11 Test Results

The "tick to trade" latency results for FIX Antenna® C++ are presented in the table below. Tick-to-trade is measured as time between two correlated TCP packets on the wire: an incoming 'X' Incremental Market Data Refresh and an outgoing 'D' New Single order.

| Percentile | Latency, us |

|---|---|

| 50% | 5.7 |

| 95% | 5.9 |

| 98% | 6.0 |

| 99% | 6.1 |

| 100% | 18.9 |

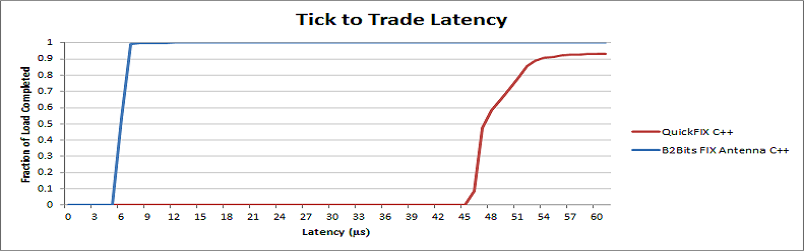

Comparison with open source QuickFIX/C

| Percentile | FIX Antenna® C++ v2.11 Latency, us |

QuickFIX/C v1.13 Latency, us |

|---|---|---|

| 50% | 5.7 | 51.9 |

| 95% | 5.9 | 57.9 |

| 98% | 6.0 | 145.4 |

| 99% | 6.1 | 175.5 |

| 100% | 18.9 | 647.6 |

The graph above shows the latency of the workload completion over a 60 microsecond range, comparing open source against the B2BITS FIX Antenna® C++ engine.

* Information source "Report: High Performance Trading - FIX Messaging Testing for Low Latency"